Mutual of Omaha offers a selection of life insurance policies to choose from including term life insurance, whole life, universal life, children's whole life insurance, and accidental death insurance. You have the option to speak with an agent in your area if you prefer, but Mutual of Omaha also lets you get a free quote or apply for any of its policies online. Mutual of Omaha also offers term and whole life coverage options with no medical exam, although not all applicants will qualify. When it comes to life insurance coverage, USAA offers term life insurance coverage for up to 30 years as well as permanent life insurance products that last a lifetime. It also makes it possible to get a free quote for both term and permanent coverage online, which means it is more transparent on pricing than many of its competitors.

Northwestern Mutual offers term life insurance coverage, whole life insurance coverage, and universal life insurance coverage. However, due to the fact it employs financial advisors who oversee your full financial picture, you will need to go through a complete financial review to get a quote. When it comes to the life insurance products it offers, State Farm lets consumers purchase term life insurance coverage, whole life insurance, and universal life insurance. State Farm also makes it easy to enter your information and get a free quote online for term life. In order to compile our list of the best life insurance companies, we researched and evaluated more than two dozen different life insurance companies. We gathered data about each company, including ratings for financial strength , customer satisfaction scores (using J.D. Power ratings), as well as pricing and customer experience.

USAA auto and home insurance and banking products are only available for military members and veterans, but it's life insurance products are available to the public. USAA boasts excellent ratings for financial strength, and it offers an array of riders you can add to your policy to bolster your benefits. Finally, USAA focuses primarily on military members, so it understands the lifestyle and risks and can make the underwriting process easier as a result. State Farm extends instant answer term life insurance coverage you can apply for online, and these policies can be purchased with no medical exam.

You do have to answer health questions in your application, however. Prudential was chosen as the best life insurance company overall based on the company history dating back to 1873, the broad selection of policies available, and excellent ratings for financial strength. Our review process gave preference to companies that offered online quoting tools and transparent pricing. We also looked at the functionality, such as online forms and customer portals, offered by carriers for customers to manage their policies and file claims online. Companies that offered multiple forms of customer service, such as phone, email, and live chat through their websites, also received ratings boosts. New York Life offers four main types of life insurance coverage—term life insurance, whole life, universal life, and variable universal life.

It also offers an array of helpful life insurance resources on its website, as well as charts that can help you compare its policies and offerings. Transamerica has you speak to an agent in order to get a quote for most of its life insurance products. Its premiums for term coverage tend to be an excellent value. To learn more about Transamerica Life Insurance check out our full review below.

Mutual of Omaha offers term and whole life insurance policies with no medical exam for applicants who qualify. This means you may be able to fill out a health questionnaire from the comfort of your home, with no invasive health exam, and get coverage when you pay your first month's premiums. American National is a group of companies writing a broad array of insurance products and services and operating in all 50 states. American National Insurance Company was founded in 1905 and is headquartered in Galveston, Texas.

In New York, business is written through Farm Family Casualty Insurance Company, United Farm Family Insurance Company, and American National Life Insurance Company of New York, Glenmont, New York. Property and casualty insurance is written through American National Property And Casualty Company, Springfield, Missouri, and its subsidiaries and affiliates. Other products and services referenced in this website, such as life insurance, annuities, health insurance, credit insurance, and pension products, are written through multiple companies.

Not all products and services are available in all states. Each company has financial responsibility only for its own products and services and is not responsible for the products and services provided by the other companies. A rider is a life insurance policy enhancement that offers additional benefits or custom coverage options to the insurance policy.

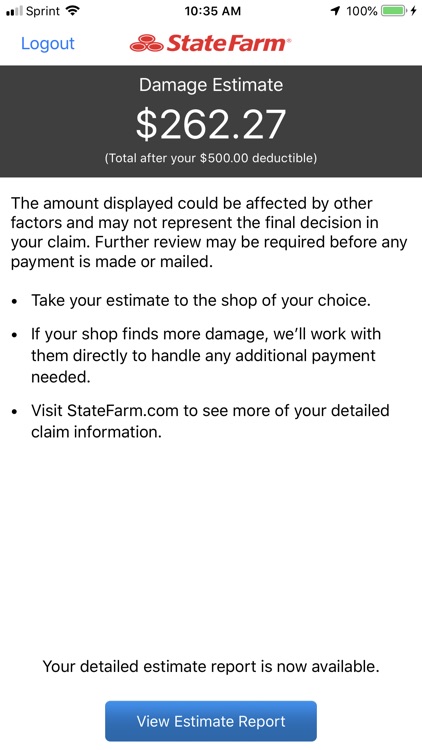

This may include coverage for a spouse or children, additional payouts for accidental death, or the ability to access policy funds early. Rider fees are typically billed as a small percentage of the policy premium or as a flat annual fee. Guaranteed-issue life insurance policies are a type of permanent life insurance that offers guaranteed approval for a small amount of coverage, regardless of the applicant's health status. No medical exam is required for approval of coverage. We chose State Farm as the best company for instant issue policies based on the fact you can apply online and get term life coverage without a medical exam or any hoops to jump through.

State Farm's excellent ratings and long history also helped it gain a spot in our ranking. He makes $100,000 per year as the sole breadwinner, and they carry $500,000 in debt ($450,000 mortgage and $50,000 in auto loans). John has decided to get 10x his salary in term life insurance coverage, plus another $500,000 to cover their debt obligations. Term coverage allows him to obtain coverage for a specific amount of time , for the lowest monthly cost.

We chose New York Life as best for term life coverage based on the fact it offers term life insurance that can convert to permanent life later on. It also offers customizable add-ons for disability or terminal illness, which you can utilize in order to build the type of coverage that best fits your needs. Prudential does let you apply for an instant online quote for term life insurance. To learn more about life insurance from Prudential, have a look at our full review. Final expense life insurance is a type of permanent life insurance designed to cover end-of-life expenses, such as funeral and burial costs. These policies are typically smaller amounts, and many offer coverage with no medical exam required.

Term policies offer temporary life insurance coverage for a fixed length of time. Most policies range from five to 30 years in length and typically offer a high death benefit for a lower premium. Term is best for young, healthy individuals looking for low-cost coverage. State Farm's phone-based agents are not in the position to negotiate your rates or to make decisions about claims. If you are concerned or upset about your rates or the status of a claim, keep in mind that a customer service representative cannot resolve such concerns to your satisfaction.

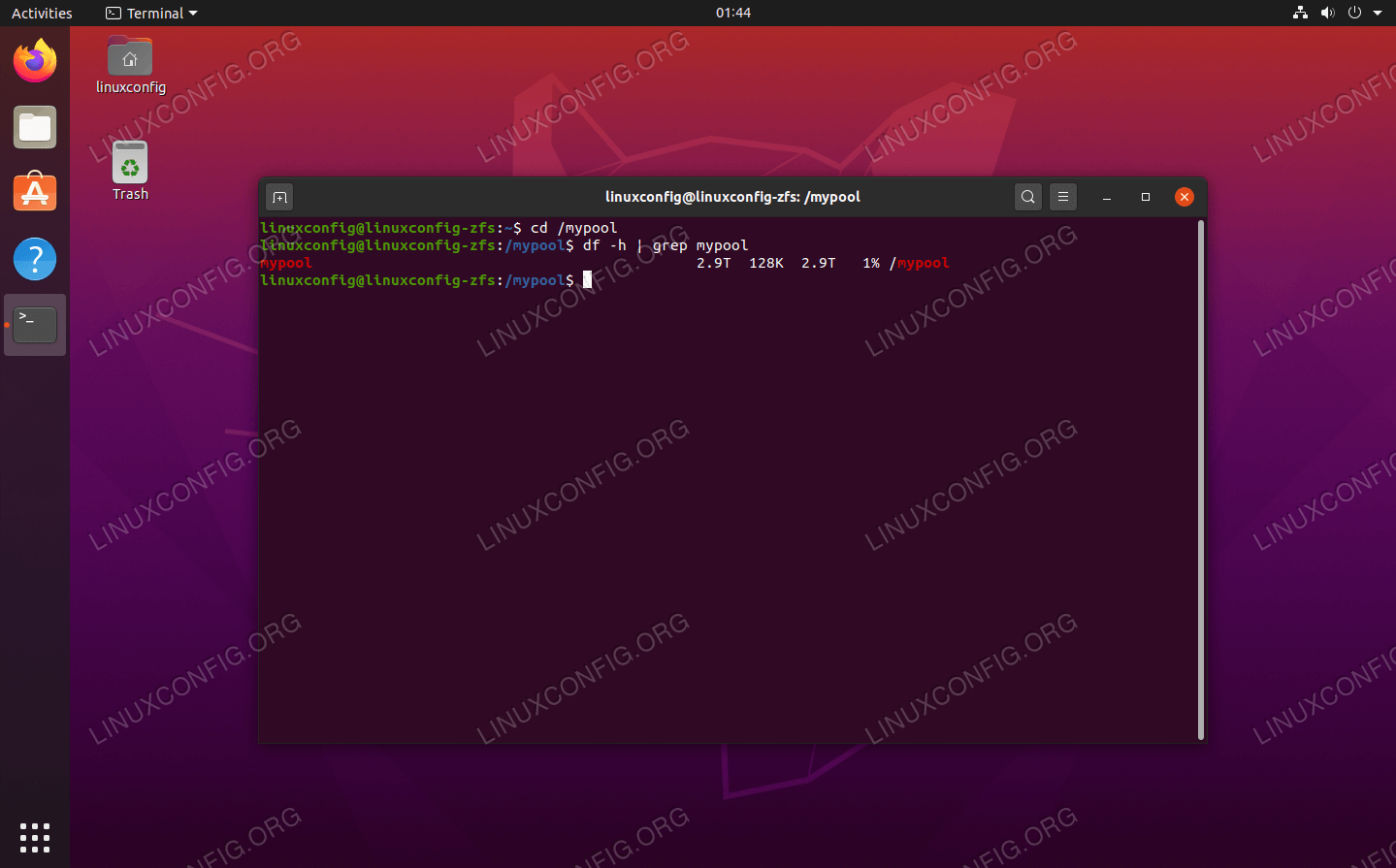

Instead, you may want to file a request or appeal with the company so that somebody with authority can address your concerns. You may also wish to speak with your insurance agent who may likewise be in a better position to provide a real resolution. Our drug cost and coverage tool makes it easy to see if a drug is covered and what you can expect to pay. To get started, sign in or register for an account at Caremark.com, or with our mobile app.

Some Business Owners policies are underwritten by Progressive. These guidelines will determine the company quoted, which may vary by state. The company quoted may not be the one with the lowest-priced policy available for the applicant. Progressive assumes no responsibility for the content or operation of the insurers' websites.

Prices, coverages, privacy policies and compensation rates may vary among the insurers. Term life insurance can provide you and your family with long-lasting financial security. You determine how much coverage you need, how long you need it, who you'd like covered, and when you pay—giving you control of your policy.

The best type of life insurance is the one that fits you and your family. This includes understanding how much coverage you want, and what the money would be used for if you pass away. You will also want to consider whether you want temporary or lifetime coverage. You may want lifetime coverage, but then learn that term policies would save a significant amount of money, as well as cover you for the highest risk years .

USAA also offers some premium rider options to its customers, including a term life event rider that lets you increase coverage by up to $100,000 without a medical exam. Other available riders include a military severe injury rider, a future insurability rider, a waiver of premium rider, and the ability to add coverage for a spouse and children. Life insurance is a great way to protect your family financially in the event of your death. Today we still answer to our members, but we protect more than just cars and Ohio farmers. We're a Fortune 100 company that offers a full range of insurance and financial services across the country.

Including car, motorcycle, homeowners, pet, farm, life and commercial insurance. As well as annuities, mutual funds, retirement plans and specialty health services. We've grown from a small mutual auto insurance company, owned by policyholders who spent their days farming in Ohio, to one of the largest insurance and financial services companies in the world. We'll explain all your coverage options and explore discounts to help you save. Learn about Erie Insurance and get an online auto quote. ERIE sells auto, home, business and life insurance through independent agents.

From customized auto insurance to superior claims service, our people and technology will support you every step of the way. Join us today and experience why we're one of the best insurance companies. Yes, you may be covered by more than one life insurance policy. In fact, stacking multiple life insurance policies is a good way to add or remove coverage as your life circumstances change.

Prudential Financial checks all these boxes and even makes it convenient by allowing you to quote policies online for up to $250,000. Of all the companies we reviewed, Prudential can fulfill the life insurance needs of more people when compared side by side to the competition. Most policies change a monthly or annual premium, with additional costs for riders. If you are looking for a low monthly cost, term policies may be a better fit, but if you want to use your insurance policy to grow your wealth, a whole or universal life policy may fit the bill . Compare costs between term and permanent policies to find what fits best in your budget. With that in mind, USAA life insurance products do not require membership and are available to the public.

USAA is a provider of insurance and banking products for U.S. military members and veterans. Need help determining how much life insurance you should have? We'll help estimate the coverage you need and provide a quote to give you a better idea of the cost you might pay to protect your loved ones' future. State Farm has a strong reputation for excellent customer service.

In addition, online and off-line searches do not reveal any patterns of reports from dissatisfied customers. This indicates that most people who call State Farm are generally satisfied with the level of support received from phone-based agents. Group health insurance and health benefit plans are insured or administered by CHLIC, Connecticut General Life Insurance Company , or their affiliates . The Cigna name, logo, and other Cigna marks are owned by Cigna Intellectual Property, Inc.

If you don't see a price, it means the drug isn't covered. Your best value is the option that can save you the most money. You can also check the price difference between having your medications delivered by mail or picking them up at the pharmacy, plus compare costs at different pharmacies in your network. And check out more ways to save by reviewing drug savings opportunities personalized just for you. Receive a quote, purchase your vehicle and select IAA Transport's door-to-door domestic and international service with real-time status updates until your vehicle reaches your preferred destination. Save time and effort with easy online payment and vehicle delivery options that ship to nearly anywhere in the world.

Protect your home, belongings, and financial security with homeowners insurance. With a variety of coverages, and plenty of ways to save, you can create a policy that keeps your home safe and fits your budget. With Progressive auto insurance, you'll enjoy affordable coverage options and a variety of discounts. Plus, you can get a quote in just a few minutes – get started now and enjoy peace of mind behind the wheel.

Overall, smokers and those with high-risk health factors will pay higher premiums, but coverage is available at most major life insurance companies. Many policies require a medical exam as well to determine your insurability. If you qualify for coverage, rates could be significantly higher. Life insured typically does not cover death as the result of suicide within two years of opening the policy.

After the contestability period, suicide is typically covered on most policies. Life insurance also does not pay out a benefit if the insured lied on any of the medical questions asked when applying for the policy. Life insurance covers most types of deaths and may offer additional benefits when the death is the result of an accident. Some life insurance policies may also accrue cash value on a tax-deferred basis, that can be borrowed against or withdrawn . For example, a 30-year-old man with a 20-year $500,000 policy will pay an average of $27.69 a month. A 30-year-old man with a $100,000 whole life policy will pay $89 a month, payable to age 99.

This is more than double the cost of term life while providing less coverage, but covering you over a longer and more risky time of your life. Selecting a life insurance policy can be a difficult decision, especially if you've never done it. Before you get started, it helps to understand not only the different options you have, but some basic terms and criteria so you pick the right policy for your circumstances.

Originally founded in 1909, Mutual of Omaha has grown tremendously over the years and is now a provider of life insurance, long-term care insurance, annuities, investments, and more. In terms of financial strength, Mutual of Omaha has an A+ rating with AM Best and an A+ rating with S&P Global. New York Life has been in business since 1845, which is a testament to its reliability in the market. This company also reports very solid ratings for financial strength, including an A++ rating from AM Best and an AA+ rating from Standard & Poor's.

Northwestern Mutual has been in business since 1857, and it has solid ratings that show its commitment to offering quality products and services. Not only does Northwestern Mutual boast an A++ rating from AM Best and an AA+ rating from S&P Global, but it also earned high marks for customer satisfaction in the J.D. Discount and savings amounts and eligibility will vary. Discounts may vary by state, property policy form and company underwriting the homeowners policy.

Discounts may not apply to all coverage on a property policy. State Farm is a major insurance and financial services company in the United States. As one of the oldest and most respected companies of its type, it is not surprising that State Farm gets a lot of requests for customer service each and every day.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.